In Addition To that, we put in each apps on one device to ensure they have entry to the identical set of data or GPS coordinates. Tracking enterprise mileage is a crucial task for small and huge companies alike. Correct information can save time and money, particularly throughout tax season.

Who Can Use The Quickbooks App?

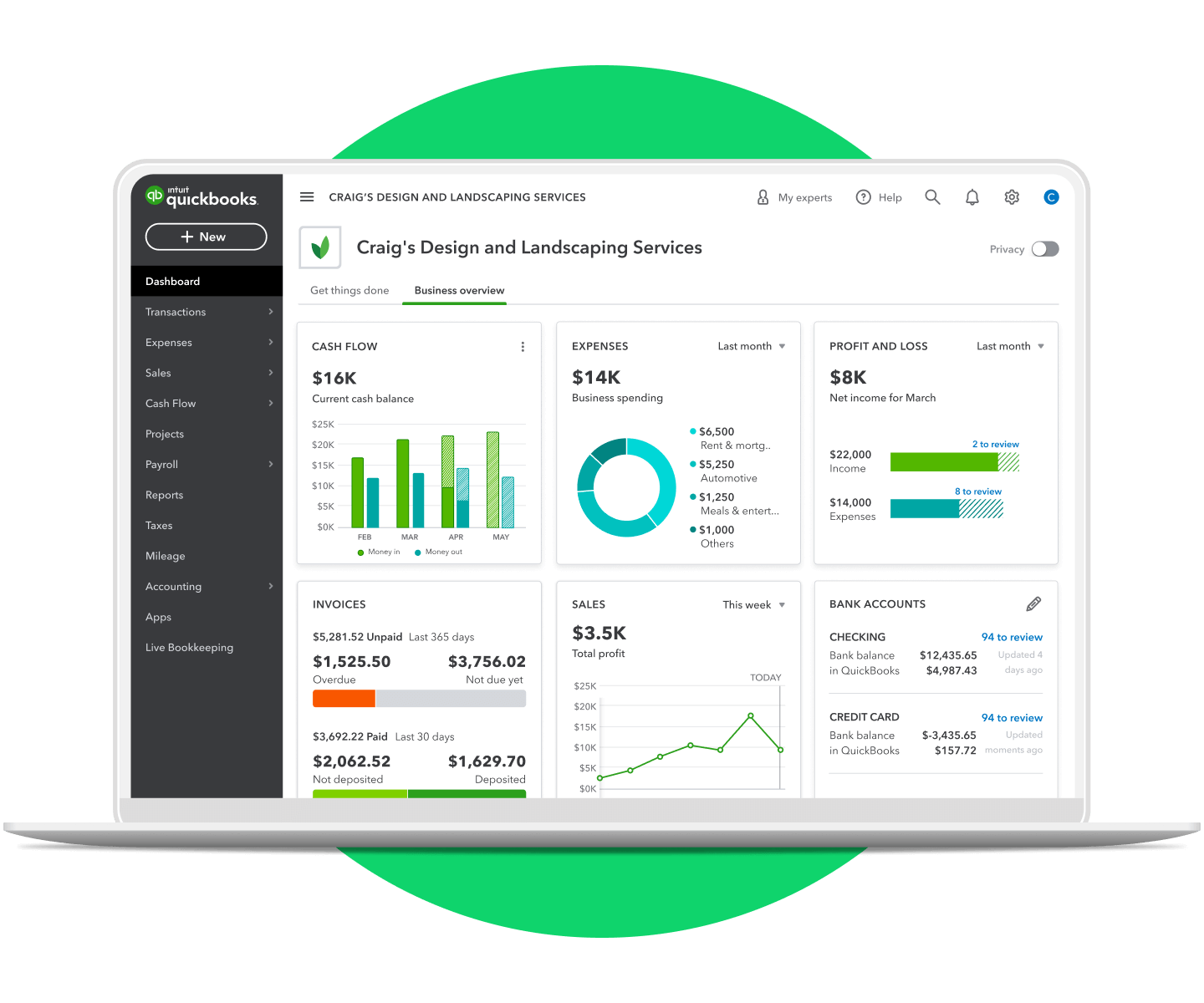

- Many customers recognize its user-friendly interface, scanning options and the power to automate and streamline financial administration tasks.

- It provides its justifiable share of perks, similar to its capacity to digitize receipts utilizing AI, immediate transaction evaluate, and Google Maps integration.

- In Distinction To QuickBooks, the place mileage is just an add-on, Timeero was constructed from the bottom as a lot as get mileage tracking right.

- While it could possibly capture the information you need, remodeling that data into client-ready invoices requires important guide effort.

If you like to not use the auto-tracking feature hurdlr review, otherwise you forgot your phone during a visit, you probably can manually add trips within the app. In the app, trips logged automatically have a small icon subsequent to them. You can also evaluate journey details to make sure the accuracy of routinely logged journeys.

Mileage reveals in Expenses, and time entries move into Timesheets. If your team also desires to log work hours, breaks, PTO, or create schedules inside the same app, Timeero is supplied with those fetures so you won’t should juggle multiple instruments later. The fact is, QuickBooks wasn’t built to handle mileage for rising teams with workers on the street. That’s why many SMBs turn to Timeero for GPS-verified mileage, team-friendly logging, and seamless QuickBooks integration. This web site is an independent, advertising-supported comparability service. We want to allow you to make personal finance selections with confidence by offering you with free interactive tools, useful information points, and by publishing unique and goal content.

Shoeboxed is best for audit trails as a outcome of it pairs limitless mileage recording with human-verified receipt capture and a searchable archive. Start a drive within the cell app, log miles with GPS, then drop paper receipts right into a prepaid https://www.quickbooks-payroll.org/ Magic Envelope or scan them in your telephone. Every receipt is extracted by optical character recognition (OCR), checked by an individual and stored with pictures you can export to PDF or CSV. Mileage and receipts land in the same expense report, which helps when a manager or auditor asks for proof. Journeys sit next to invoices, funds and receipts, which keeps information in a single place should you already run your books here.

Tax-hub Enterprise Options

This means you won’t need separate spreadsheets or apps, preserving everything consolidated underneath one umbrella. No extra juggling between applications—your financial journey becomes more streamlined. Segmented monitoring splits mileage between purchasers, advised mileage highlights inefficient routes, and commuter exclusion removes non-reimbursable miles routinely.

You can stuff your receipts into one of our Magic Envelopes (prepaid postage throughout the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap an image whereas on the go. Or ahead a receipt to your designated Shoeboxed email tackle.

By Accessing And Utilizing This Page You Comply With The Phrases And Circumstances

Additionally, consolidating all this data into one platform makes financial planning less complicated and extra intuitive. Not needing multiple instruments means much less room for error and extra room for development. In essence, QuickBooks takes you from guesstimating to exactly understanding your mileage expenses.

If you are a rideshare or supply driver, maximizing your deductions at tax time will save you a ton of money, however you’ll want one of the best mileage tracking app to do that. Hurdler’s mileage dashboard tallies each journey into a monthly view so you can instantly see business drives, total miles and tax deductions without extra math. MileIQ is best for recognition because it’s the app most individuals think of first when mileage tracking comes up. With over 80,000 five-star critiques throughout the app shops and deep ties to Microsoft 365, it has a level of adoption that few opponents can declare. That visibility issues if you want a software that your accountant already is aware of, your staff have most likely used and your tax software program will accept with out clarification. QuickBooks Online is the best for accounting because mileage lives inside the identical ledger you already use for invoicing, expenses and reporting.

Most mileage apps simply record trips, however MileageWise audits each entry towards 70 red-flag criteria before you finalize it. That degree of detail issues when you’re staring down an audit, because you aren’t left scrambling to patch holes in your information. The Google Timeline import and AI log generator are unique—if you neglect to trace, the software program can rebuild your log retroactively and nonetheless meet IRS requirements. The QuickBooks cell app acts as a digital mileage log by monitoring and categorizing the miles you drive for work.

To confirm your mileage, the IRS requires you to submit a log of all your small business trips that features the miles pushed, your begin and finish factors, and the date and time of the drives. The biggest downside for rideshare drivers contemplating Zoho is that you must manually enter your mileage for each journey. Nevertheless, the app is fairly user-friendly and provides you a number of data entry options.